Lab-grown gourmet foods are moving from futuristic fantasy to tangible fine-dining reality. From cell-based foie gras to cultured salmon sashimi, chefs and biotech firms are experimenting with creations that promise luxury without animal suffering or ecological strain. Regulators in Singapore and the US have already given green lights to some products, while Europe and Australia test their own pathways. Investors are betting billions on the promise of cultivated gastronomy, yet the hurdles of cost, scalability, and consumer trust remain high. This report explores where science meets haute cuisine — and whether the lab can truly rival the farm and the field.

Trend Snapshot

| Aspect | Details |

|---|---|

| Trend Name | Lab-Grown Gourmet |

| Key Components | Cell cultures, bioreactors, scaffold engineering, flavor innovation |

| Spread | Approved in Singapore & US, pilots in Israel, Australia, EU in review |

| Examples | Cultivated salmon, foie gras, quail, lamb mince, tuna |

| Social Media | Growing traction on Instagram, TikTok, FoodTech channels |

| Demographics | Early adopters, eco-conscious luxury diners, food innovators |

| Wow Factor | Fine dining without slaughter, radical sustainability |

| Trend Phase | Early adoption with investor momentum |

Global Regulatory Milestones

The road from petri dish to plate is paved with regulatory hurdles. Singapore took the first step in 2020, granting approval for Eat Just’s cultivated chicken. This positioned the city-state as the pioneer of lab-grown foods and offered a testbed for consumer acceptance. In the United States, the Food and Drug Administration (FDA) has since moved further, approving multiple cultured chicken products. In June 2025, the FDA also approved Wildtype’s cultivated salmon for public consumption, a landmark expansion beyond poultry.

Australia and Israel are also moving aggressively. Israeli start-ups enjoy strong government backing and local pilot tastings, turning the nation into a living laboratory for cellular agriculture. In Australia, companies like Vow are positioning themselves as global leaders, experimenting with gourmet products rather than bulk meats. According to The Australian, Vow’s portfolio includes quail foie gras and lamb mince, targeting high-end restaurants first.

By contrast, Europe lags behind. Under the EU’s Novel Food Regulation, approvals are slow and require exhaustive safety data. While this ensures high consumer protection, it risks leaving European innovators behind their global competitors. The regulatory mosaic underscores how fragmented the global rollout remains: while some markets are already plating lab-grown luxury, others still debate its place in the food chain.

Gourmet Creations & Culinary Innovation

Unlike earlier cultured meat initiatives that focused on mass-market staples like burgers, the current wave of lab-grown innovation is aiming higher. Fine dining and luxury foods provide a more strategic entry point: customers are willing to pay premium prices, and chefs are looking for differentiation.

One of the most striking examples is foie gras. Traditionally controversial due to force-feeding practices, foie gras has become a litmus test for how cultivated food can replace products tainted by ethical concerns. Start-ups in Europe and Australia are working on foie gras derived from duck or quail cells. A Wall Street Journal feature highlighted Vow’s experimental foie gras, demonstrating how the product could appeal both to gourmet chefs and ethically minded consumers.

Seafood is another frontier. Cultivated salmon, tuna, and even eel are being developed as answers to overfishing, mercury contamination, and the ecological toll of aquaculture. The Japanese fine-dining tradition makes seafood a natural focus, and cultivated alternatives promise consistency, purity, and traceability. Wildtype’s FDA-approved salmon represents a step toward integrating lab-grown fish into sushi bars and luxury restaurants worldwide.

What sets these products apart is not only their ethical profile but also their potential for innovation. Scientists and chefs can design fat content, texture, and flavor profiles that go beyond mimicry. This raises the tantalizing prospect of “post-natural” gastronomy — dishes that never existed in the natural world, tailored for sensory delight.

Science Behind the Plate

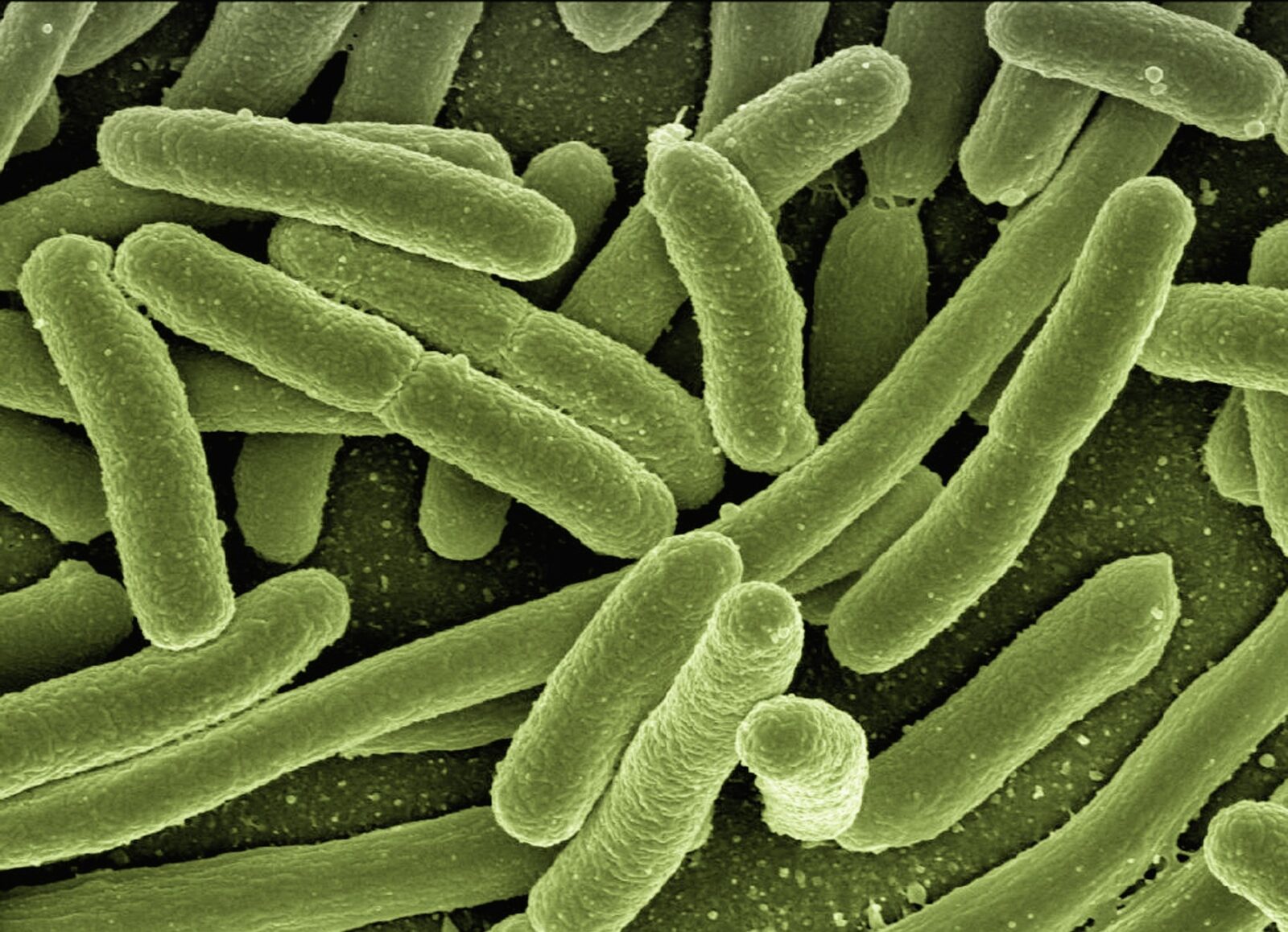

Cultivated gourmet food begins with cells, often stem cells or myosatellite cells extracted from an animal without killing it. These cells are nurtured in nutrient-rich media containing amino acids, sugars, salts, and growth factors. The controlled environment of a bioreactor allows cells to proliferate, forming the foundation of meat tissue.

Texture is a major challenge. While ground meats are easier to produce, structured products such as fillets or foie gras require scaffolds — 3D frameworks that guide cells to grow into complex tissue structures. Researchers experiment with edible scaffolds made from plant proteins, algae, or even 3D-printed biomaterials. These approaches aim to replicate marbling, chewiness, and mouthfeel.

Another bottleneck is the cost of growth factors. Traditionally sourced from fetal bovine serum (FBS), they are both expensive and ethically problematic. The industry is racing to develop serum-free alternatives using recombinant proteins or plant-based formulas. This transition is essential to achieve cost competitiveness and scalability.

Despite progress, the energy intensity of bioreactors and the complexity of scaling up remain formidable. Unlike beer brewing, where yeast cells multiply almost indefinitely, animal cells are more fragile. Each batch requires precision, hygiene, and stability. As such, cultivated meat companies function as both food producers and biotech labs, walking a tightrope between culinary promise and technological constraint.

Benefits and Barriers

The theoretical benefits of lab-grown gourmet foods are compelling. On the ethical front, no animals are slaughtered, and controversial practices like foie gras force-feeding could be eliminated. Environmentally, the potential savings in land, water, and biodiversity are vast. Cultivated seafood promises freedom from mercury, microplastics, and overfishing. For consumers, it offers the allure of fine dining with a conscience.

Yet the barriers are equally clear. Current production is costly, with prices often exceeding what even luxury restaurants can absorb. Energy use in bioreactors is significant, raising questions about the actual carbon footprint compared to traditional agriculture. Consumer perception is another hurdle: while younger demographics show more openness, others remain skeptical of “lab-grown” foods, perceiving them as unnatural or unappetizing.

Moreover, questions remain around nutrition and long-term safety. Regulatory agencies demand exhaustive testing to ensure cultured foods are equivalent — or superior — to conventional counterparts. Until scalability is achieved, cultivated gastronomy will remain a niche, not a mass-market solution.

Market Outlook & Investor Buzz

Investors have poured billions into the cultured meat and seafood sector, betting on its potential to disrupt protein markets. High-profile venture funds, food corporations, and even sovereign wealth funds are backing start-ups across Israel, the US, and Asia. The strategy often starts with gourmet products, where higher margins can offset high production costs.

According to industry analysts, the luxury positioning serves as both a revenue and branding strategy. By placing cultivated foie gras or salmon in Michelin-starred restaurants, start-ups can generate buzz, normalize the concept, and build desirability. Over time, as production costs fall, these products could trickle down into premium supermarkets and eventually mass retail.

However, consolidation is already visible. Dozens of start-ups entered the space in the early 2020s, but only a handful secure regulatory approval and sustained funding. Partnerships with established food companies are critical, as these giants bring distribution, marketing, and political clout. Cultivated gastronomy may start as a niche, but its success will hinge on integration into the broader food ecosystem.

The most likely scenario is a hybrid market: cultivated foods filling luxury and specialty niches first, while plant-based and conventional proteins continue to dominate mainstream diets. Still, the symbolic power of a lab-grown foie gras served in Paris or Tokyo could redefine what it means to dine sustainably in the 21st century.

Science & Ethics

Lab-grown gourmet food sits at the intersection of science, ethics, and culinary ambition. Regulatory approvals in Singapore, the US, and Australia demonstrate that the technology is viable, while investor enthusiasm underscores its disruptive potential. Yet high costs, technical barriers, and consumer skepticism suggest a long runway before mainstream adoption.

For now, the trend thrives in the luxury segment, where cultivated foie gras, salmon, and quail intrigue chefs and diners alike. Whether the lab will ultimately rival the farm depends on scaling breakthroughs and shifting perceptions. But one thing is certain: haute cuisine is being reimagined cell by cell, dish by dish.

Explore more emerging food trends at Wild Bite Club: www.wildbiteclub.com